W2 payroll calculator

If you have questions regarding information within the W2 Tax Form or the 1095c Tax form please visit the Payroll Tax Forms Direct Deposit page. Although most working individuals receive these forms Independent contractors file in a separate manner.

You Need An Expert To Help You Get That Form 941 Amended To Get Loads Of Cash Back That Belongs To You In 2022 Payroll Taxes Business Marketing Strategy

Take home pay is calculated based on up to six different hourly pay rates that you enter along with the pertinent federal state and local W4 information.

. Calculate and print employee paychecks in all 50 states as well as Puerto Rico Guam Virgin Islands and American Samoa. As many already know 1099 contractors must pay both the employee and employer portion of the payroll taxes. Youll see your social security number Box A name Box E and address Box F appear here while your employers employer identification number EIN Box B name and address Box C and control number Box D if any appear here as well.

You can prepare form 941 W-2 1099-misc and others one at a time online or upload a data file to file by the thousands. ADP Wisely Pay Card. It is also important to put these pay conversions in the larger context of your business structure and employment practices.

Try another browser edit your bookmarks or clear your internet history and cache. Switch to Massachusetts salary calculator. Paycheck Calculator exempt Paycheck Calculator non-exempt Contact.

Run payroll for hourly salaried and tipped employees. You can print PDF copies after submission or ask us to print and mail forms W-2 W-2c and 1099-misc. A 1099 vs W2 pay difference calculator can be a great tool for employers and hiring managers.

Our income tax calculator calculates your federal state and local taxes based on several key inputs. Did you know that reporting inaccurate holdings on a W4 form is possibly one of the most common payroll errors out there. 905 Asp Avenue Room 244 Hours of Operation Lobby Hours.

ADP Wisely Pay Card. Earning Statements with iPay. This Massachusetts hourly paycheck calculator is perfect for those who are paid on an hourly basis.

Used the contractor option and it was simple. A Form W2 and Form W4 are very different although many individuals and companies use and mess them up interchangeably. You can start things off by doing some of the following.

Servers and other gratuity based professionals. How do I use the Free Payroll Calculator. Use free or paid Paycheck Calculator app and precise Payroll Guru app to calculate employees payroll check in the residence state.

Payroll Employee Services is dedicated to serving the diverse university community by providing precise and timely remuneration to all staff faculty. The Payroll department is responsible for processing salary wage fellowship and special payments for all Virginia Tech employees. Apply Visit Give Apply Visit Give.

Lowest price automated accurate tax calculations. How to use Free Calculator. Payroll Journal Payroll Register Employees W2 and 109910981096 forms.

The FREE Online Payroll Calculator is a simple flexible and convenient tool for computing payroll taxes and. ESmart Payroll has been providing IRS authorized payroll e-file since 2000. In addition to the above AGI also determines the contribution amounts to IRAs and other qualified savings plans.

Last Minute W2 1099 Filing Solution Important Tax. AGI Adjusted Gross Income is an individuals total gross income after the deduction of certain allowable expenses. Payroll department responsibilities include but are not limited to all payroll related tax deposits and related reporting administration of the timekeeping system W2 processing filing administration of unemployment reporting and claims.

Manage payroll for Free. This lets us find the most appropriate writer for any type of assignment. If youre confused by tax forms and get your 1099s mixed up with your W2 read on.

2020 W-4 IRS Withholding Calculator. 1099-MISC Form 1099-NEC Form W4 Form. Using eSmartPaycheck you can prepare paychecks calculate federal and state taxes print checks and pay stubs and print 941 and W2 forms for free.

Use Abacus Payrolls free Tip Tax Calculator to calculate the amount of your paycheck. Thousands of US-based businesses use our tool to provide proof of income and payroll services to their employees and contractors. HR Help Center Login.

Our global writing staff includes experienced ENL ESL academic writers in a variety of disciplines. Calculate net paycheck federal taxes payroll withholdings including SDI and SUI payroll state taxes with ease and on the. Your household income location filing status and number of personal exemptions.

Choose a Login Path. AGI helps you to determine your federalstate income taxes and also your eligibility for certain tax credits. Didnt use the calculator or deductions options.

Easy to use quick way to create your paycheck stubs. The payroll lobby is only available for walk-ins from 830 am. If you want to simplify payroll tax calculations you can download ezPaycheck payroll software which can calculate federal tax state tax Medicare tax Social Security Tax and other taxes for you automatically.

Fast easy accurate payroll and tax so you save time and money. These boxes on the W-2 provide all the identifying information related to you and your employer. Free paystub maker tool is specially designed to generate printable pay stubs in PDF format at your Email for easy download share online without repaying.

Use our free check stub maker with calculator to generate pay stubs online instantly. Try paystub maker and get first pay stub for free easily in 1-2-3 steps. Monday - Friday in accordance with the university holiday schedule and campus closures.

Payroll deferral or employer pre-tax HSA contributions up to the applicable limit reported on Form W-2 as non-taxable are excluded from your gross income. Register to save paychecks generate form 941 w2 etc. Also we separately calculate the federal income taxes you will owe in the 2020 - 2021 filing season based on the Trump Tax Plan.

Small Business Payroll 1-49 Employees Midsized to Enterprise Payroll 50-1000 Employees Time Attendance. Explore our full range of payroll and HR services products integrations and apps for businesses of all sizes and industries. Try Free Pay Stub creator to generate paystubs without Watermarks online include all company employee income tax deduction details.

You can try it free for 30 days with no obligation and no credt card needed. You can claim a tax deduction for HSA contributions up to the applicable limit made outside of payroll deferral even if you dont itemize your deductions on Form 1040. If you are having issues logging in filing or paying taxes use these troubleshooting tips.

The 1099 vs W2 distinction is what separates employees from the self-employed.

Ready To Use Paycheck Calculator Excel Template Msofficegeek

Paycheck Calculator Online For Per Pay Period Create W 4

Payroll Calculator With Pay Stubs For Excel

Payroll Calculator Free Employee Payroll Template For Excel

What To Do If Your W 2 Or 1099 Is Stolen Tax Return Payroll Software Tax Preparation

Easy To Use Payroll Software For Small Businesses Ezpaycheck Payroll Software Payroll Taxes Payroll

Tax Withholding Calculator For Employers Online Taxes Irs Taxes Federal Income Tax

Payroll Calculator With Pay Stubs For Excel

Fillable Form W2 2015 Edit Sign Download In Pdf Pdfrun Irs Tax Forms Credit Card Services Tax Forms

Hours Wage Calculator Sale Online 50 Off Www Wtashows Com

Tax Calculation Spreadsheet Spreadsheet Spreadsheet Template Business Tax

Hourly Paycheck Calculator Templates 10 Free Docs Xlsx Pdf Salary Calculator Paycheck Pay Calculator

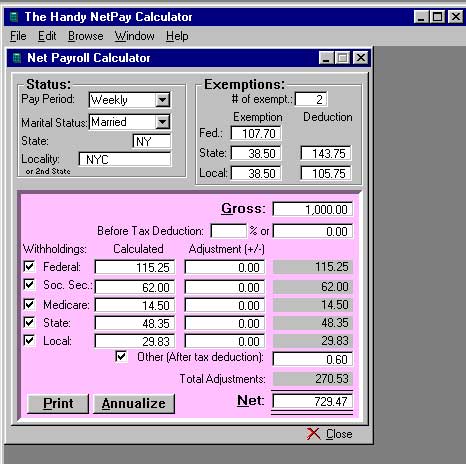

W 2 1099 Filer Software Net Pr Calculator

Payroll Calculator Free Employee Payroll Template For Excel

Top 6 Free Payroll Calculators Free Paycheck Calculator App Timecamp

With Stubcreator Com Reliable Pay Stubs Are Generated Instantly Which Are Available For Print At The Same Time All Thanks To Its Paycheck Salary Calculator

Understanding Your Tax Forms The W 2 Tax Forms W2 Forms Tax Time